As Donald Trump's tariff storm continues to create market turmoil, Jeff Kendrick, the Digital Assets Research Head at Standard Chartered, has made a bold prediction about cryptocurrencies that could surge in the near future.

According to Kendrick, Bitcoin and AVAX are the "winners", with Ethereum notably absent from the list. He predicts that AVAX could rise tenfold by the end of 2029, presenting a promising outlook for the blockchain ecosystem.

Why Standard Chartered Believes Bitcoin and AVAX Will Shine After Halving?

Regarding Bitcoin, Kendrick emphasizes investor accessibility and volatility levels as two key factors influencing long-term pricing. With the introduction of spot Bitcoin ETF in the US and potential improvements under the Trump administration, he predicts Bitcoin could reach $500,000 before Trump leaves office.

"As the ETF market matures, we expect volatility to gradually decrease, and the optimal gold-Bitcoin portfolio allocation will increase. Accessibility and lower volatility will enable Bitcoin to reach $500,000 before Trump leaves office." – Jeff Kendrick, Digital Assets Research Head at Standard Chartered

Other experts share Kendrick's optimistic outlook. They believe Bitcoin will continue its upward trajectory after halving, driven by factors such as a weakening US dollar, increasing M2 money supply, and potential Federal Reserve rate cuts. Arthur Hayes, former CEO of BitMEX, predicted Bitcoin could reach $250,000 by the end of this year.

Beyond Bitcoin, Kendrick identifies AVAX as a high-growth candidate. He attributes AVAX's potential to the Etna upgrade, which significantly reduced subnet configuration costs. Currently, a quarter of Avalanche subnets are Etna-compatible, which has prompted many developers to move from Ethereum layer 2 solutions to Avalanche.

"As a result, we see AVAX outperforming Bitcoin and Ethereum in relative price appreciation over the next few years, expecting it to reach around $250, over 10 times its current price, by the end of 2029." – Jeff Kendrick, Digital Assets Research Head at Standard Chartered

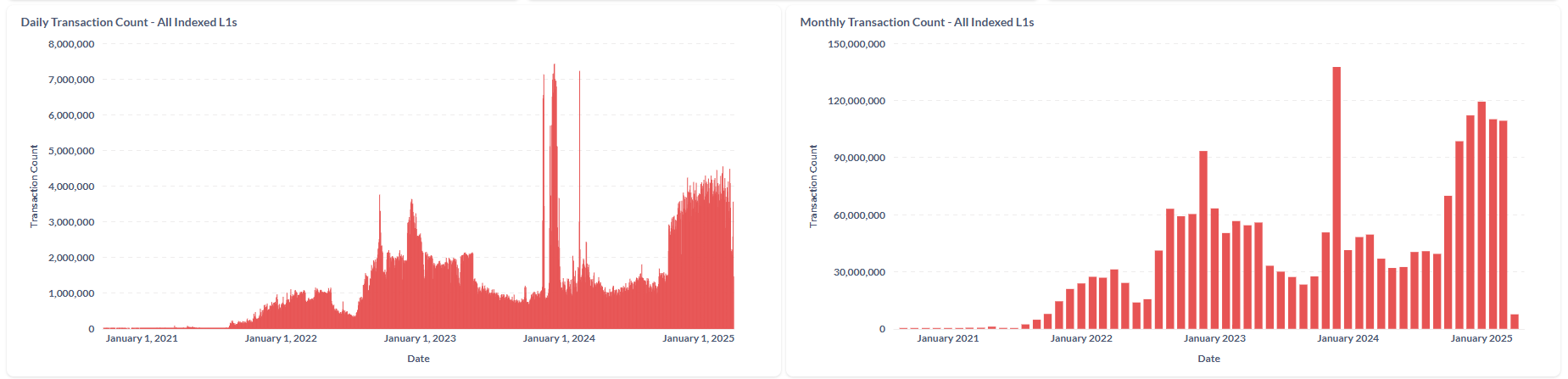

According to AVAX network data, Avalanche is expected to process over 4 million transactions daily and maintain over 100 million monthly transactions by 2025, which is three times the 2024 average.

Ethereum Struggling

Unlike Bitcoin and AVAX, Ethereum shows a less optimistic outlook. Kendrick has revised his Ethereum price prediction for the end of 2025 to $4,000, significantly down from his previous $10,000 forecast. He argues that layer 2 blockchains aimed at improving Ethereum's scalability have actually harmed the ecosystem.

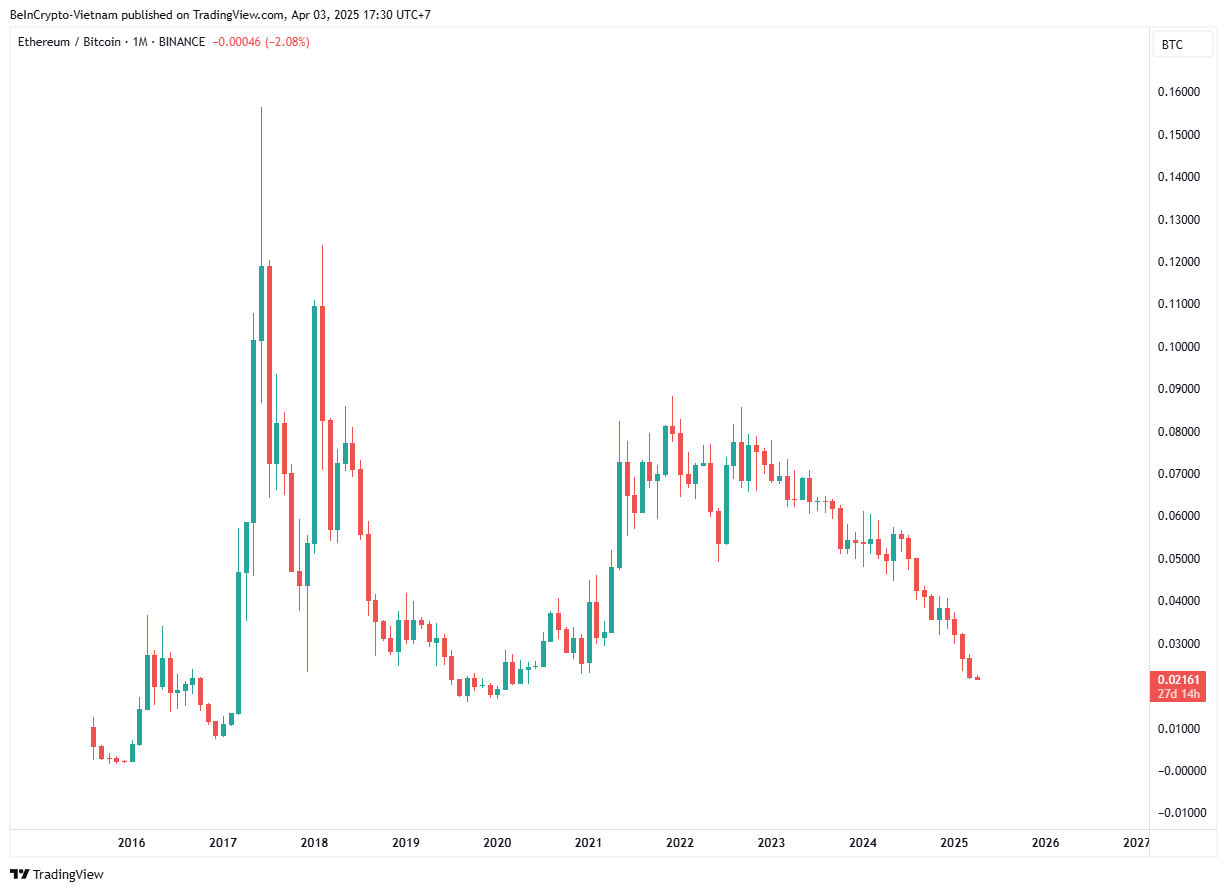

"Layer 2 blockchains were designed to improve Ethereum's scalability, but we estimate that the primary layer 2, Base, has removed $50 billion from Ethereum's market cap. Assuming no change in direction from the Ethereum Foundation, we see ETH-BTC continuing to decline. We now expect ETH-USD to reach $4,000 by the end of 2025." – Jeff Kendrick, Digital Assets Research Head at Standard Chartered

At the time of writing, ETH/BTC has fallen to 0.021 BTC, reaching its lowest level since 2021. Analysts emphasize that the proliferation of layer 2 solutions has fragmented Ethereum's ecosystem, contributing to its disappointing price performance over the past year.

Standard Chartered's prediction paints a fragmented picture of the cryptocurrency market after halving. Bitcoin remains dominant due to increased accessibility and volatility stabilization.

Meanwhile, Avalanche is emerging as a strong competitor in the EVM blockchain space. Despite Ethereum's fundamental role, it may face significant challenges if it does not address its current limitations.