The 'Kimchi Premium', where cryptocurrency prices are higher in Korea compared to overseas, has slightly decreased.

According to CryptoPrice at 8:50 AM on the 25th, the Kimchi Premium (Upbit<>Binance) is recording 0.2%.

Maintaining a similar level to the previous day, the domestic and international price difference remains minimal. Major altcoins such as Ethereum, SOL, and Doge are also showing a premium of 0.2-0.3%, similar to the previous day.

Kimchi Premium Status by Coin

BTC $95,045.99 / ₩136,849,000 / 0.20%

ETH $1,798.93 / ₩2,594,000 / 0.35%

SOL $147.94 / ₩213,200 / 0.29%

XRP $2.296 / ₩3,304 / 0.16%

DOGE $0.1790 / ₩258.0 / 0.29%

Kimchi Premium is a phenomenon where cryptocurrency prices are higher on Korean exchanges, caused by a sudden increase in domestic demand or lack of overseas liquidity. An expanded Kimchi Premium indicates strengthened domestic buying pressure or relative strength of the domestic market compared to global prices.

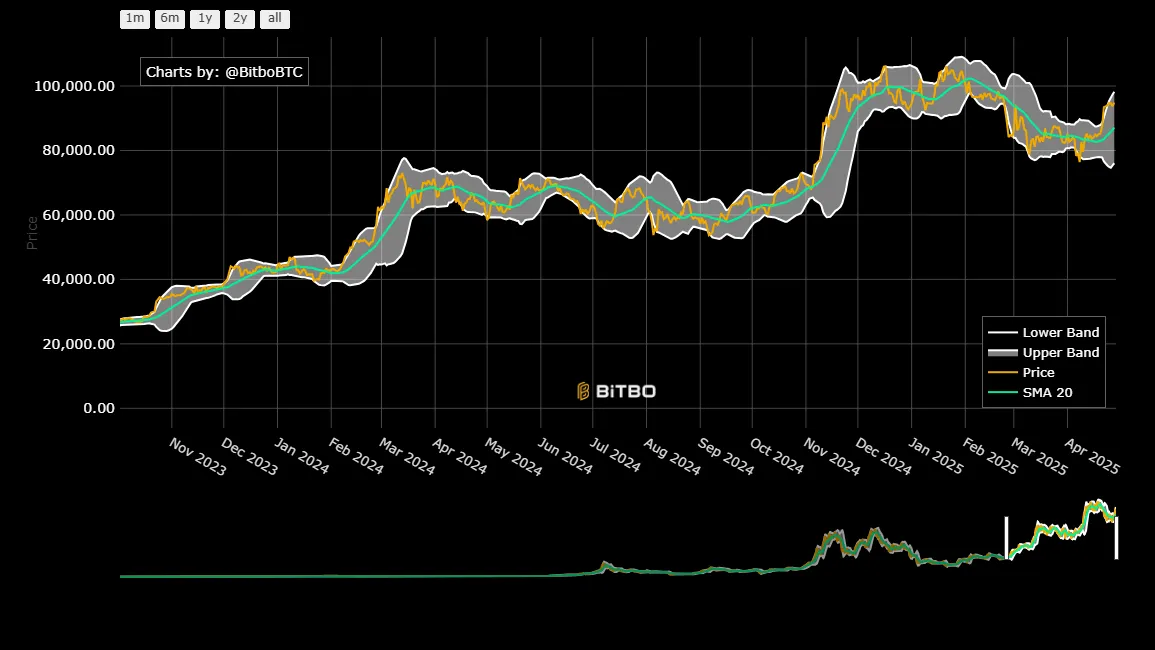

Bitcoin Technical Analysis

The upper Bollinger Band is at $98,226.69, and the lower band is at $76,038.56. Breaking the upper band indicates an overbought state with potential correction (decline), while breaking the lower band suggests an oversold state with potential rebound.

Currently, Bitcoin is trading at $95,010. It continues its strong trend, rising 1.32% from the previous day ($93,723.27). Overheating signals are gradually strengthening, and the possibility of entering an overbought zone in the short term is increasing.

The widening band width suggests the possibility of increased volatility in the future. The current range is at a point where directional momentum is about to fully develop, with a high likelihood of a strong trend continuing. Particularly, the current position relative to the band's center line ($87,132.63) maintains an upper bias, making the short-term bullish advantage more pronounced.

The 20-day moving average is located at $87,132.63. The current price is about $7,900 above this, further strengthening the upward trend.

The RSI (Relative Strength Index), which measures price rise and fall intensity, is at 68.12, up from the previous day (62.9). It is transitioning to a strong bullish trend beyond neutral and is approaching the overbought zone (70). If the RSI breaks the 70 mark, the possibility of additional strong buying pressure is open.

Currently in the pre-overbought zone, breaking near $98,000 in the short term could enhance additional upward momentum. However, as the divergence from the moving average is intensifying, there is also a possibility of some technical adjustment around $95,000.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

News in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>