Welcome to the US Morning Cryptocurrency News Briefing. We will comprehensively summarize today's important cryptocurrency developments.

Check out analysts' opinions on Bitcoin while drinking coffee. A showdown is happening between BTC giant Strategy (formerly MicroStrategy) and Jack Mallers' investment company 21 Capital. With their Bitcoin models being questioned, is there a specific definition of victory in Bitcoin?

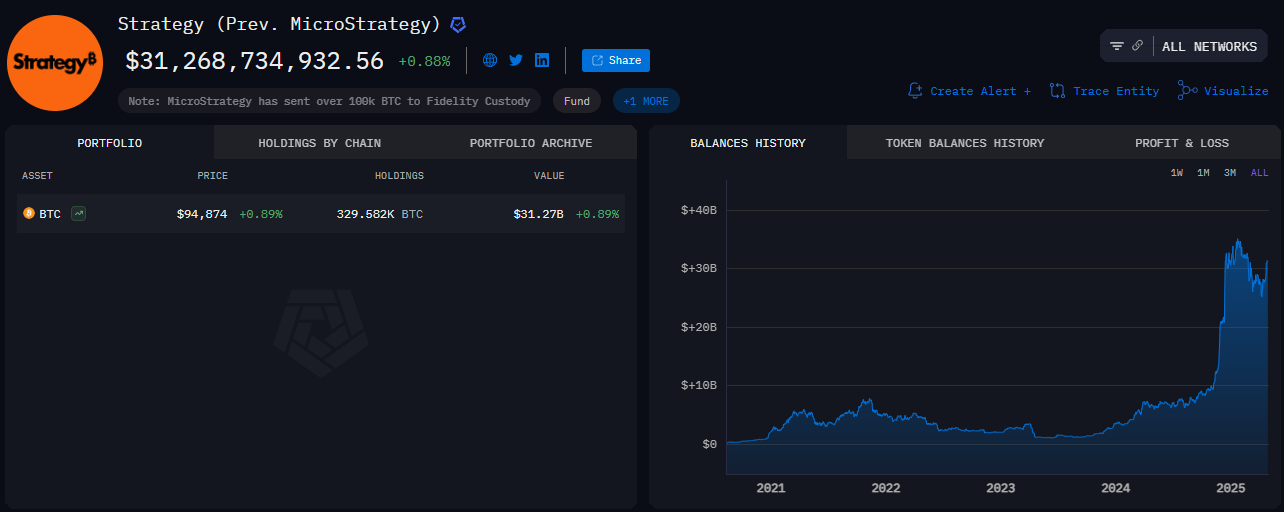

Strategy Increases Bitcoin Reserves... Purchases $1.42 Billion BTC

Strategy recently announced purchasing 15,355 BTC for approximately $1.42 billion. The average purchase price is $92,737.

The company currently holds 553,555 BTC, valued at around $52.7 billion. The average purchase price is $68,459, with unrealized gains of $14.8 billion.

"By continuing to increase Bitcoin holdings, the company maintains its position as a major force in the cryptocurrency market, attracting investor and industry analyst attention. Strategy is the largest Bitcoin financial company, an independently listed business intelligence company, and a Nasdaq 100 stock," Phoenix reported.

Meanwhile, as Strategy accelerates Bitcoin purchases, 21 Capital is beginning a 'viral effect' of companies transitioning to BTC accumulation.

Recent US cryptocurrency news publications highlighted 21 Capital's emergence. This Bitcoin investment company was formed after Cantor Fitzgerald, SoftBank, Tether, and Bitfinex raised $3 billion.

Emotionally, this new venture could casually challenge Strategy's leading corporate Bitcoin ownership in terms of model. According to 21 Capital, Strategy's scale could make per-share Bitcoin increases difficult, a metric investors consider.

Amid rumors that it could threaten Strategy led by Michael Saylor, BitStrategy, a Strategy shareholder, challenged the business model of this potential market competitor.

Bitcoin Treasury Tension Escalates

In a detailed post on X (Twitter), BitStrategy acknowledged tension in the Bitcoin financial sector. However, they claim Strategy is far ahead in competition.

"Their company is directly competing with us, attempting to exploit weaknesses in our structure, and publicly emphasizing their strengths to attract investment," BitStrategy challenged in a recent post.

Beyond BTC returns, as reported in recent US cryptocurrency news publications, the company recently started key performance indicators BTC Gain and BTC $ Gain.

- Bitcoin Gain reflects the company's operational scale by multiplying BTC returns with total balance.

- Bitcoin $ Gain converts this to dollars, providing additional transparency.

Strategy's aggressive approach indicates a willingness to defend its position as a leading Bitcoin holding company amid increasing competitors.

"You can fake impressive BTC returns, but you can't fake impressive BTC Gain," BitStrategy said.

However, analyst Kenji Koshu argues that while Strategy can show substantial Bitcoin returns, smaller companies like 21 Capital can achieve higher Bitcoin per share.

"As someone who has deeply considered why MSTR is undervalued, MSTR's BTC returns can still be substantial and will support the stock on a per-share basis. But when using the same strategy, it's hard to deny that a smaller, similarly reputable company will generate more Bitcoin per share," the analyst wrote.

This perspective aligns with 21 Capital's sentiment that Strategy's large scale hinders per-share Bitcoin increases.

However, BitStrategy emphasized the importance of BTC Gain and BTC $ Gain from a holistic company performance perspective, contrasting with the per-share viewpoint.

According to shareholders, there is no consensus traditional evaluation methodology for Bitcoin companies. This means all metrics are somewhat arbitrary.

In this confusion, BeInCrypto contacted Bitcoin adoption pioneer Max Keiser.

"For companies to survive, they must emulate Strategy's process, and if they don't 'Saylorize', they will die," Keiser told BeInCrypto.

According to Keiser, the world is moving towards the Bitcoin standard, and while stablecoins may support this, all fiat currencies are destined for fate.

Today's Chart

Today's Key News

- Bitcoin is approaching $95,700. This is driven by extreme greed and high optimistic sentiment on social media.

- Investors are increasingly choosing digital assets as a safe haven. Bitcoin is establishing itself as a hedge against US dollar volatility, and cryptocurrency inflows have surged to $3.4 billion.

- Ethereum's new proposal could increase TPS to 2000. It presents a deterministic, exponential growth plan that gradually raises the gas limit.

- Bitwise CEO says the current Bitcoin rally is driven by institutional investors, not FOMO. He explains the sharp decrease in Bitcoin search volume on Google Trends.

- ProShares' XRP futures ETF approval has triggered optimism. There are predictions that a spot ETF could follow. This could attract $100 billion to XRP.

- Three cryptocurrency airdrop opportunities this week provide investors with early entry into projects with high growth potential. This is inspired by notable financial support.

- New XRP address creation reached a two-week high of 3,677. This indicates increased investor confidence and new market capitalization.

- World Liberty Financial founders met with Changpeng Zhao in Abu Dhabi. They discussed standardization and global adoption efforts in the cryptocurrency industry.

Cryptocurrency Stock Pre-Market Overview

| Company | Closing on April 25 | Pre-Market Overview |

| MicroStrategy (MSTR) | $368.71 | $373.50 (+1.30%) |

| Coinbase Global (COIN) | $209.64 | $208.71 (-0.44%) |

| Galaxy Digital Holdings (GLXY.TO) | $20.63 | $20.54 (-0.44%) |

| Marathon Holdings (MARA) | $14.30 | $14.41 (+0.77%) |

| Riot Platforms (RIOT) | $7.77 | $7.84 (+0.90%) |

| Core Scientific (CORZ) | $8.31 | $8.37 (+0.72%) |