April passed relatively smoothly with a decrease in network demand and sideways price movements. The second-largest cryptocurrency, Ethereum (ETH), may be poised for change.

ETH holders are optimistic about May. This optimism is driven by strengthened fundamentals, the anticipated Petra upgrade, and increased institutional investor interest through spot ETH ETFs.

Challenging ETH in April… Hope for May?

In April, on-chain data showed a decrease in user activity across the Ethereum network. Due to market stagnation, ETH traded below major resistance levels.

According to Artemis, user demand for Ethereum dropped significantly over 30 days. This resulted in a decrease in the number of active addresses, daily transactions, and network fees and revenues.

This market downturn affected ETH's performance. The price of the major altcoin remained below $2,000 throughout April.

However, in an interview with BeInCrypto, Gabriel Halm, a research analyst at IntoTheBlock, said that ETH's price could break through and stabilize above $2,000 in May.

For Halm, increased capital inflows into the ETH spot ETF, Ethereum's dominance in the DeFi sector, and the upcoming Petra upgrade could help realize this.

ETF Inflows, DeFi Dominance, Petra… Ethereum's Triple Catalyst in May

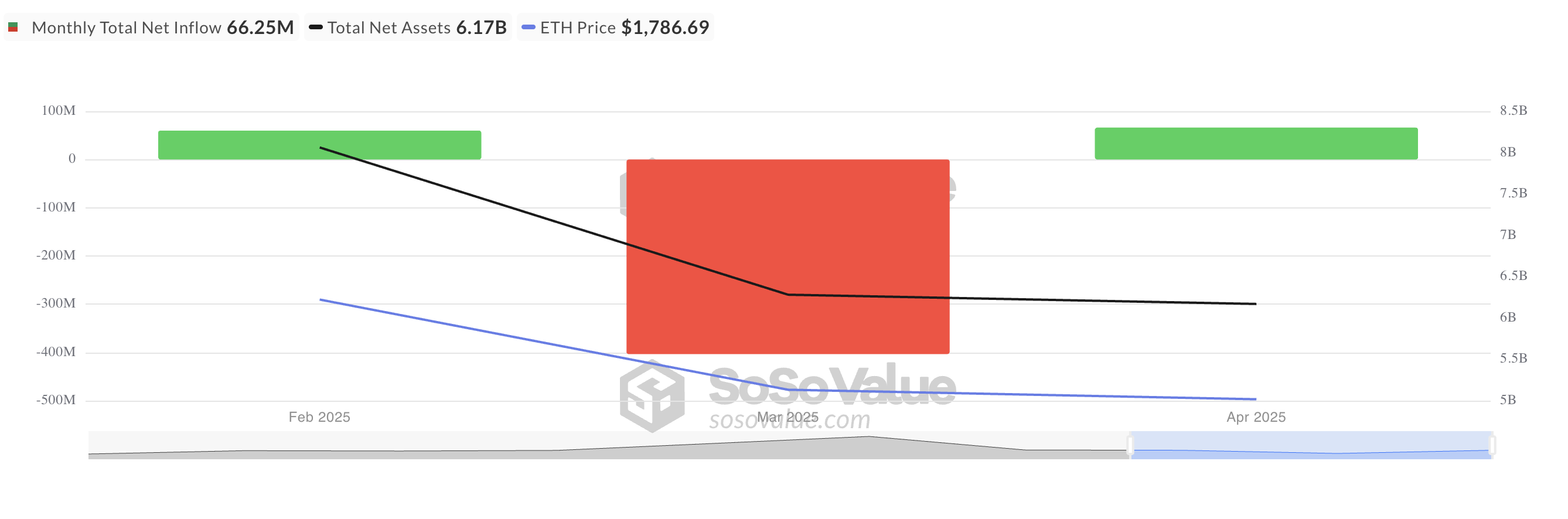

According to SosoValue, monthly net inflows into the ETH ETF in April reached $66.25 million. Compared to the net outflow of $403.37 million in March, this indicates a shift in market sentiment.

This transition from large outflows to small inflows suggests that investor confidence in altcoins is gradually recovering. This may indicate that institutional investors are preparing for a long-term rebound, especially as Ethereum's network fundamentals begin to improve, including rising dominance in the DeFi sector.

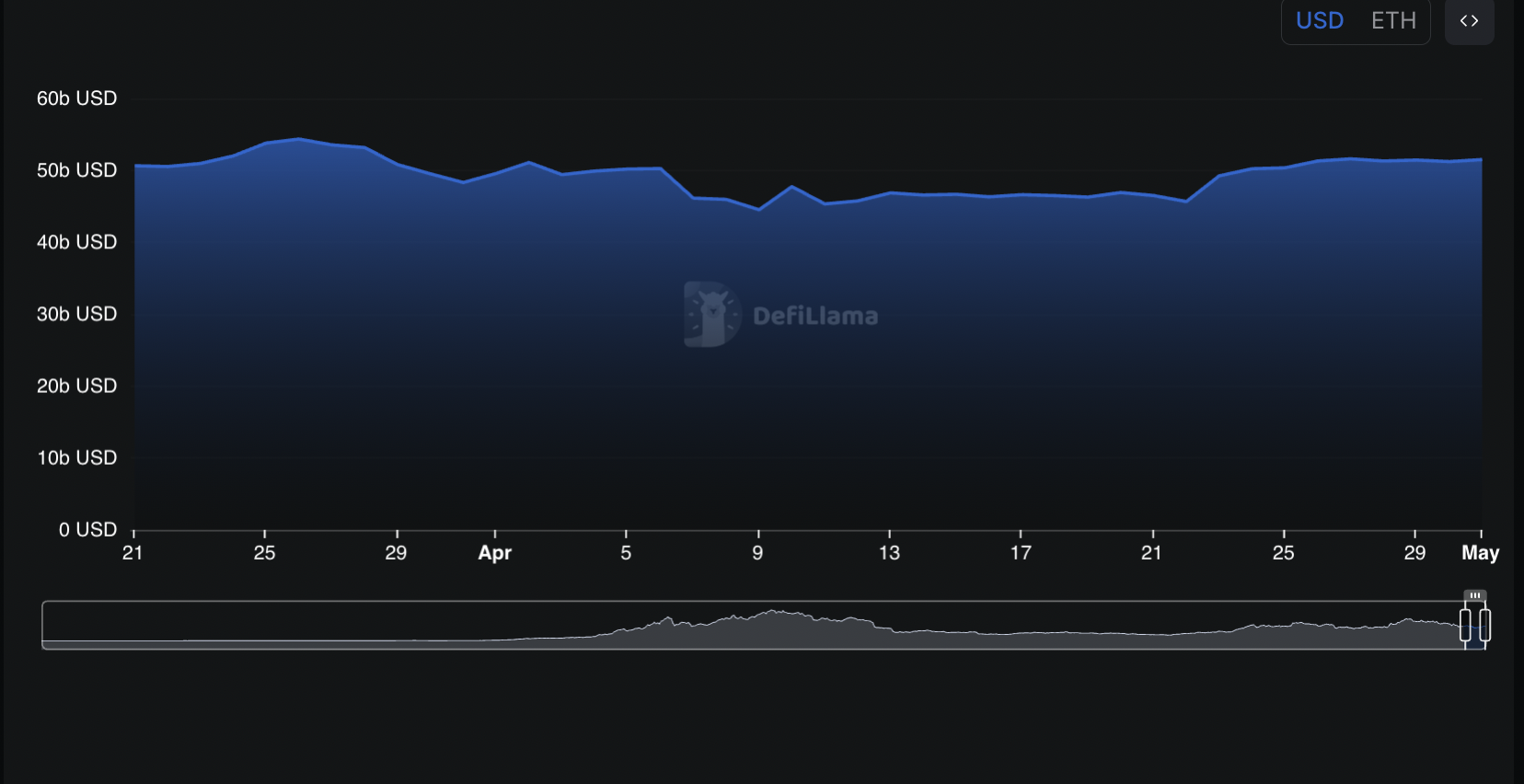

Over 50% of the total value locked (TVL) in DeFi protocols is still on the Ethereum blockchain. This means Layer 1 remains the preferred settlement layer for various financial applications like lending, staking, yield farming, and decentralized exchanges.

Therefore, if market conditions improve in May, capital inflows into Ethereum's DeFi sector could increase. This could boost demand for ETH and support price appreciation.

Additionally, according to Halm, Ethereum's upcoming Petra upgrade is scheduled for release on May 7, 2025. This upgrade will improve network scalability, reduce transaction fees, enhance security, and introduce smart account features.

These improvements could drive a surge in user demand throughout May, potentially raising ETH's price if macroeconomic conditions remain favorable.

ETH Growth Depends on Market Stability

Nevertheless, broader economic pressures pose significant risks to ETH in May. Halm noted, "The CPI report scheduled for release on May 13 is particularly important. It can influence market sentiment and contribute to volatility."

This is because the Federal Reserve's inflation or hawkish signals could worsen risk-averse sentiment in the cryptocurrency market, potentially pressuring ETH's price.

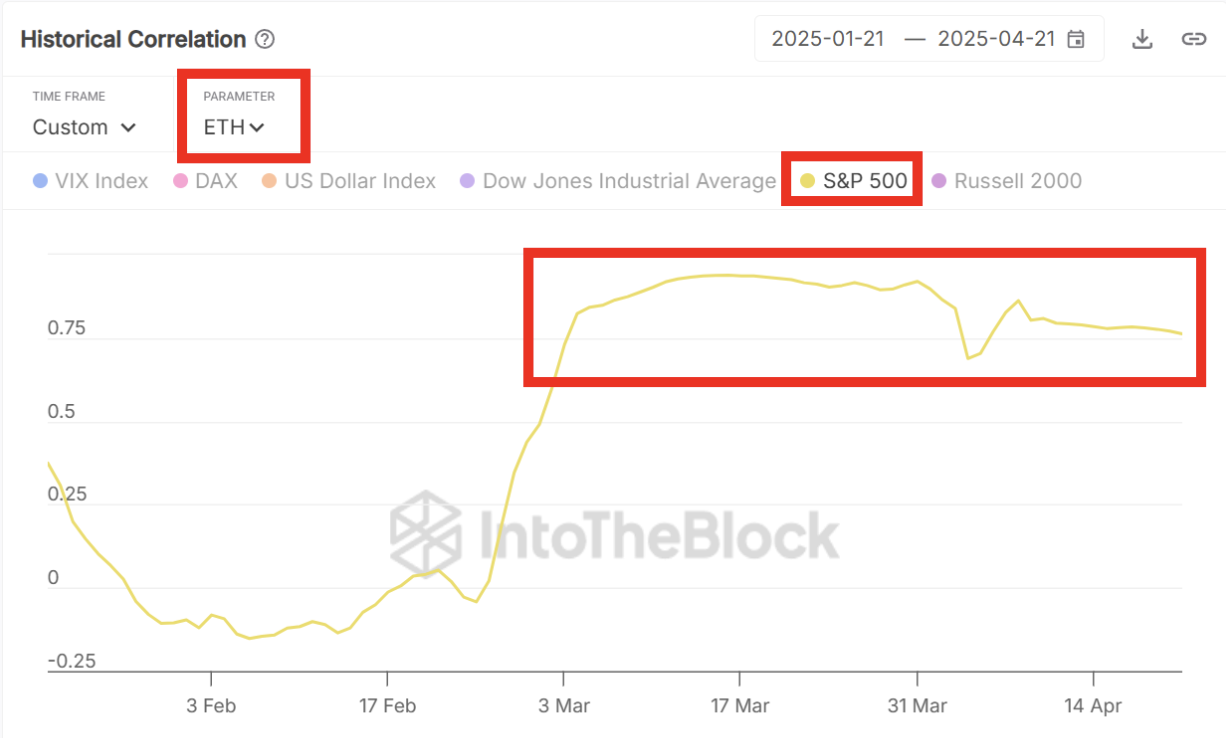

Halm also pointed out that ETH's price is closely correlated with US stocks. Therefore, if the stock market experiences stress this month due to inflation concerns or rate hike expectations, altcoins could face similar pressures.

"Looking ahead to May, if this high correlation persists, Ethereum's market decline and vulnerability to inflation-related pressures will be similar to traditional risk assets like the S&P 500. A general market downturn or increased concerns about inflation affecting stocks could negatively impact ETH's price." – Gabriel Halm, Research Analyst at IntoTheBlock

Sustained growth above $2,000 is possible, but will be determined by inflation trends, risk sentiment in traditional markets, and how closely ETH is connected to stocks.