Ethereum (ETH) blockchain is experiencing developer exodus as competing ecosystems like Solana (SOL) gain attention.

The Solana blockchain is attractive to developers due to excellent support for startups and a simplified user experience.

Ethereum Hackathon Mistake...Moving to Solana

Ethereum has long been the primary smart contract platform for decentralized applications (dApps). However, this position is now threatened, with Jacob Franek, co-founder of Alliance Crypto Accelerator, issuing a strong warning.

According to Franek, Ethereum's excessive dependence on hackathons does not provide meaningful innovation. In his view, such mistakes could cause the network to lose its advantage.

"If the Ethereum community wants to reverse this trend, they need to support the great developers who are building apps." – Jacob Franek, Co-founder of Alliance Crypto Accelerator

Franek points out that hackathons are generally not for serious developers and rarely produce good products.

"A $5,000 prize does not fund companies that change the world," he said.

This criticism highlights disappointment with Ethereum's developer ecosystem strategy. While hackathons have increased, practically adopted products have been scarce.

In contrast, Solana's ecosystem focuses on structured startup support, with the Solana network becoming the preferred location for new Web3 founders.

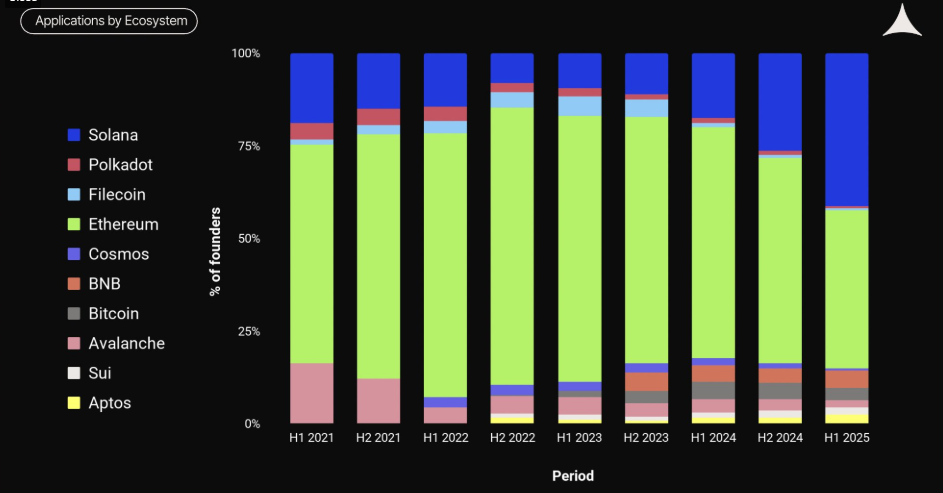

"Latest data for startups applying to Alliance: Ethereum and Solana are now neck and neck. But momentum favors Solana, and soon it will likely be the first ecosystem for founders." – QwQiao, Alliance DAO Customer Support

QwQiao also shared a chart showing that approximately 35% of startups are supporting an alliance with Solana. Meanwhile, the percentage supporting an alliance with Ethereum was around 30%.

The chart shows a notable change from a point when Ethereum occupied about 50% and Solana was less than 10%.

These concerns coincide with Solana recently overtaking Ethereum in staking market capitalization. This is a key indicator reflecting network value and user trust. Therefore, these results strengthen Solana's dominance among investors and developers.

Beyond the technical perspective, this change indicates a shift in perception about where future innovation and economic opportunities lie in cryptocurrency.

Proposed Structural Solutions for Ethereum

This trend for Ethereum occurs within a broader narrative crisis. Once praised as the world's computer, Ethereum is now positioning itself as a deflationary store of value. Its identity has become confused.

Critics argue that Ethereum lacks a unified narrative to draw support from community and institutions. This is especially true when compared to Solana, which emphasizes speed, usability, and mobile-first design.

In this context, Franek suggests increasing funding for accelerators, incubators, and ecosystem venture funds.

This means shifting capital from abstract research to practical product development.

He also points out the composability issues with Ethereum's Layer 2 solutions and the need to more aggressively expand the base Layer-1 (L1). He warns that if these frictions are not resolved, Ethereum will struggle in competition.

"...Evidence from Web2 apps over decades shows that users hate friction. UI and onboarding must be extremely simple. 99 out of 100 times, users will choose the app with the least resistance." – Jacob Franek, Co-founder of Alliance Crypto Accelerator

It is crucial for Ethereum to reconfigure its developer engagement strategy to maintain its significance amid new developer preferences and technological priorities.

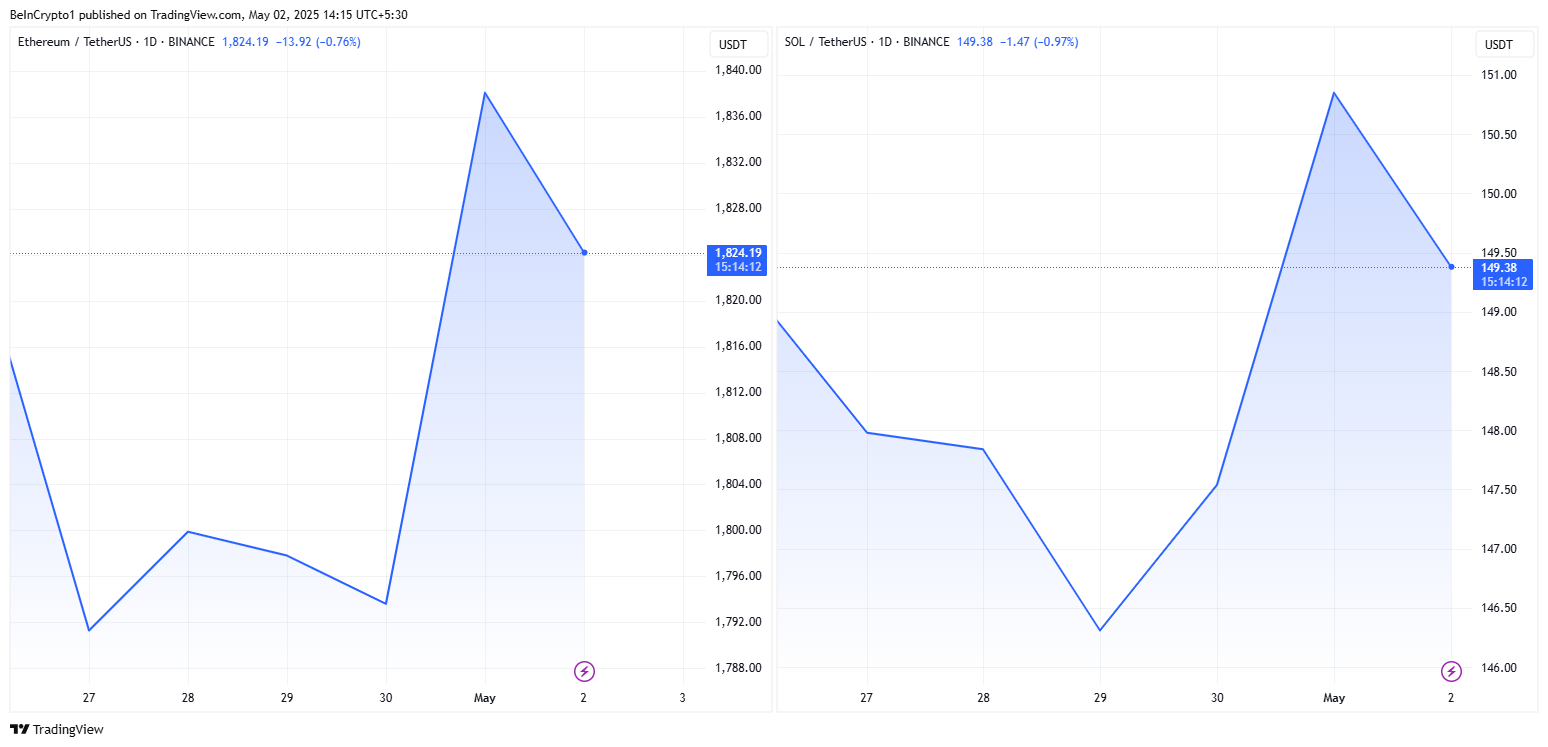

At the time of writing, ETH is trading at $1,824.19, slightly up 0.5% in the past 24 hours. Meanwhile, SOL is trading at $149.38, down 0.74% during the same period.