Bitcoin has been showing a steady upward trend throughout April, with its price approaching the important $100,000 mark. This upward momentum appears to be driven by new capital inflows as investor sentiment strengthens.

If this trend continues, Bitcoin could become a catalyst for reaching a new peak, with the $105,000 level potentially serving as a trigger for additional price increases.

Bitcoin Gains Investor Support

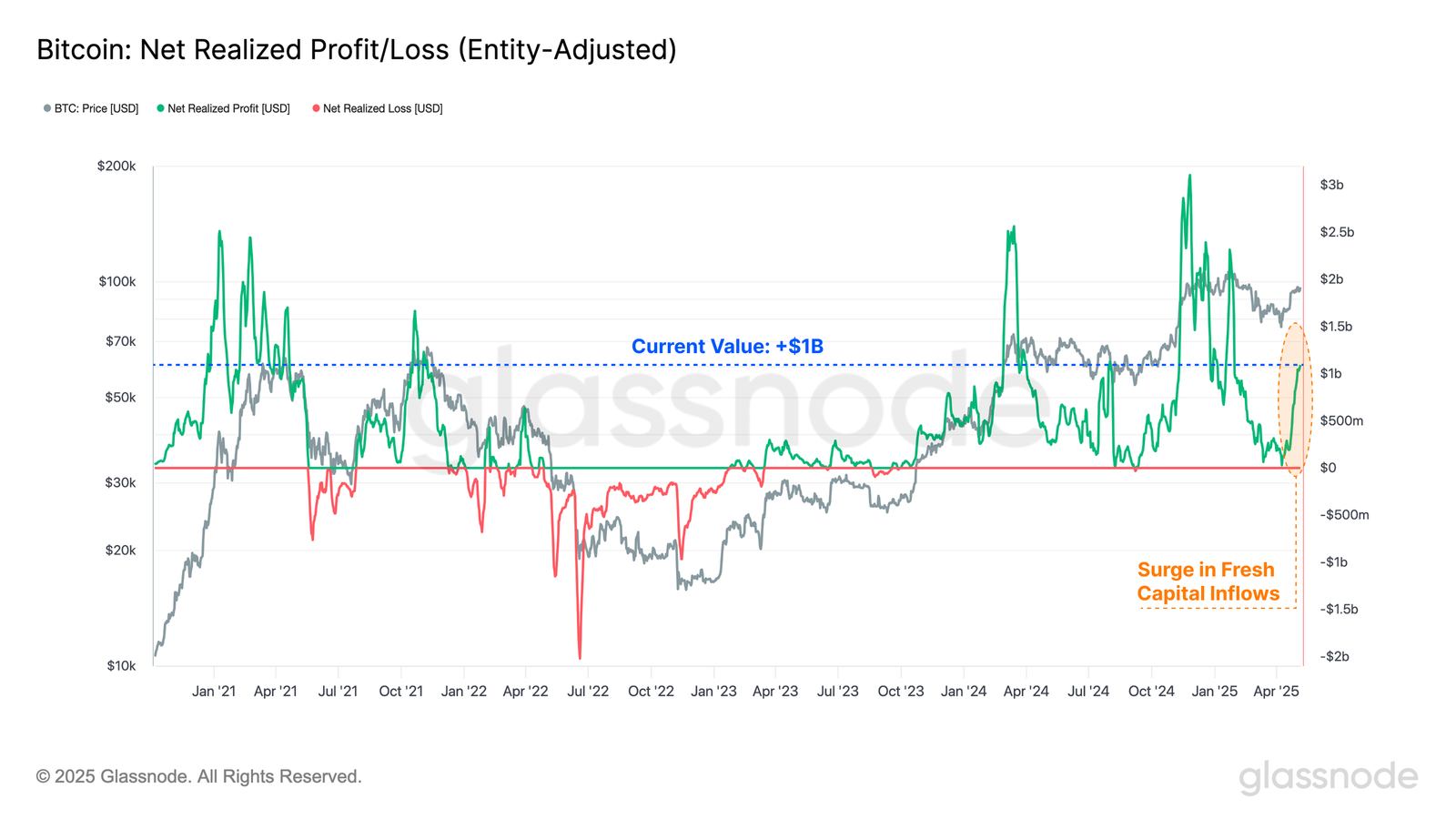

In recent weeks, there have been net capital inflows of over $1 billion per day, indicating strong demand for Bitcoin. The net realized profit/loss indicator reflects these inflows, showing that new investors are absorbing the incoming supply. Sellers are realizing profits, while buyers continue to purchase Bitcoin at the current market price.

Generally, significant profit-taking is considered a bearish signal indicating a market peak. However, for Bitcoin, this point occurs when realized profits exceed $1.5 billion, and BTC currently has room for growth.

Moreover, since October 2023, the market has maintained a profit-oriented regime, with capital inflows continuously exceeding outflows. These steady new capital inflows reinforce positive market sentiment, reflecting the strong momentum during the October 2023 rally. The balance of supply and demand indicates strong market sentiment and suggests Bitcoin is preparing for further increases.

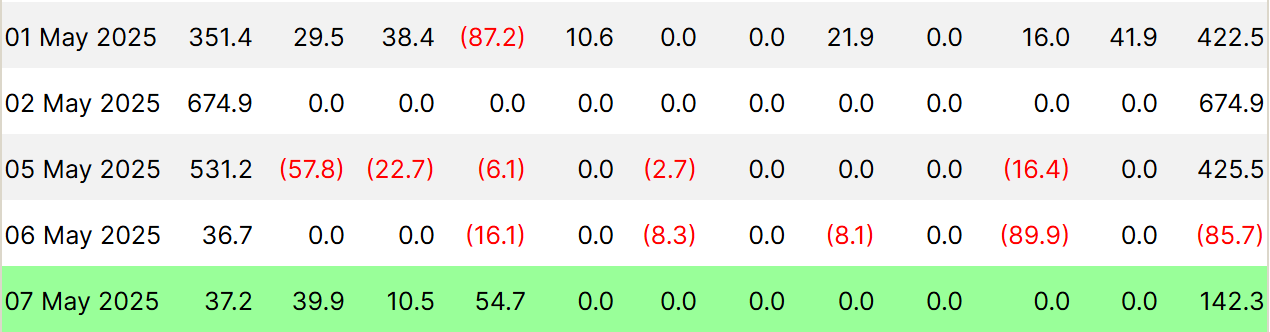

Beyond strong market sentiment, Bitcoin's overall macro momentum is supported by positive spot ETF flows. These inflows remained largely positive last week, continuing except for an $85 million outflow recorded on May 6th.

This decline was related to uncertainty surrounding the US Federal Reserve's interest rate decision. However, the overall trend of spot ETF flows still suggests strong demand, which could support Bitcoin's price movement.

BTC Price Shows Strength

Bitcoin is currently trading at $98,827 on the daily chart, just below the critical $100,000 resistance level, reaching a two-month high. If the market continues to show strength and investor confidence remains solid, Bitcoin could transform $100,000 into a support level, opening the path for further increases.

Bitcoin's next major target is $105,000. Breaking through this level is crucial for Bitcoin to maintain momentum and firmly establish itself in the six-digit range. If Bitcoin secures this level, it could eventually reach $110,000 and extend its bullish rally.

However, if market conditions deteriorate and investor sentiment weakens, Bitcoin may struggle to break through the $100,000 resistance. In this case, the price could drop back to $93,625, invalidating the current bullish outlook and delaying recovery.