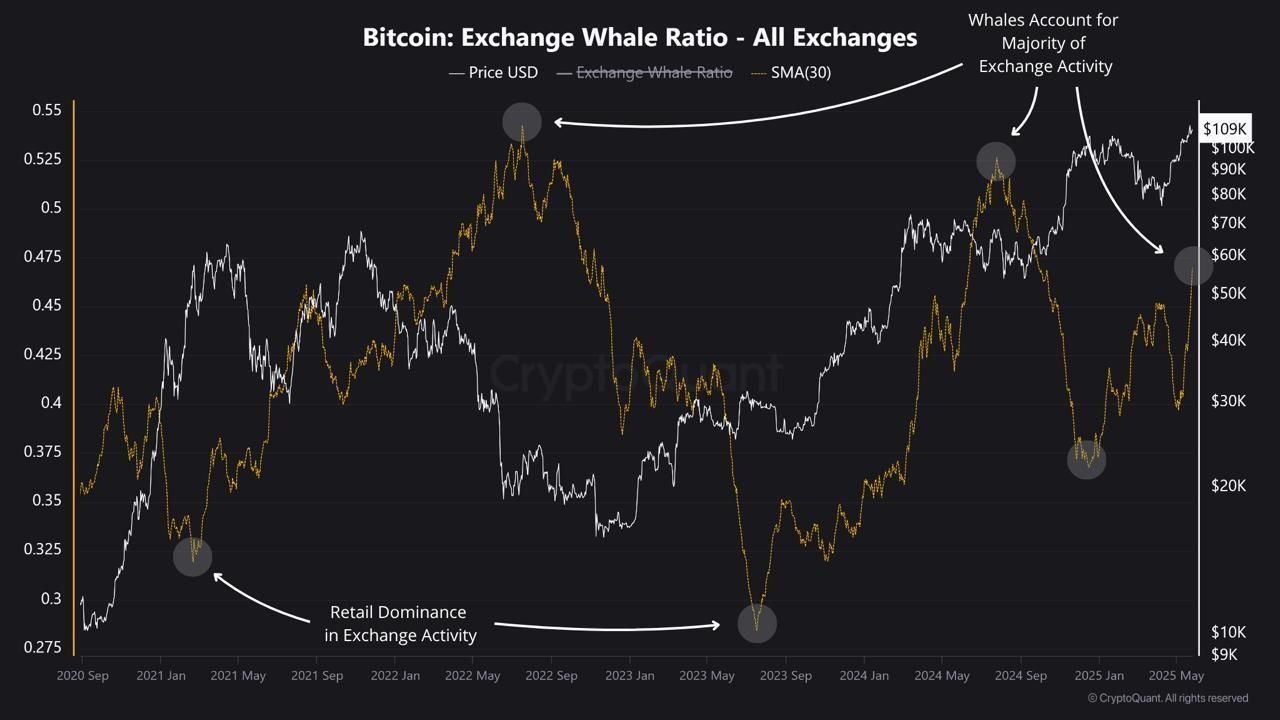

Bitcoin whales are regaining dominance in exchange activities. The 30-day moving average of the exchange whale ratio has surged to 0.47, reaching its highest level in 7 months. This indicates that nearly half of all BTC flowing into exchanges is occurring in the largest trades.

Historically, such a surge in whale activity has occurred before major market peaks. Large holders tend to move funds in preparation for selling. As retail participation decreases and whale influence increases, the market may transition to a distribution phase, increasing the risk of short-term corrections.

Is a Bigger Bitcoin Crash Coming?

Bitcoin recently broke through $111,000, recording a new all-time high. However, due to whale profit-taking and potential further macroeconomic downturn, BTC has dropped over 6% and is currently trading at $104,000.

According to CryptoQuant data, the exchange whale ratio has risen sharply, warranting caution.

Historically, when this ratio exceeds 0.5, with whales dominating exchange inflows, price peaks have frequently occurred.

The exchange whale ratio measures how much of all Bitcoin flowing into exchanges is comprised of the top 10 trades. A 30-day moving average of 0.47 means nearly half of BTC deposits are "whale" trades.

This pattern appeared during previous market cycles, such as mid-2022 and late 2024. Significant corrections occurred whenever whale activity increased.

This suggests large holders tend to move funds to exchanges in anticipation of selling. This often occurs at local peaks.

Conversely, when the whale ratio drops below 0.35, it often indicates an accumulation phase or early bull market momentum driven by retail participants.

A clear example is mid-2023, when the ratio hit its lowest point and Bitcoin subsequently began steadily rising.

"We're seeing increased dominance of large holders in recent exchange activities. This sharp increase is similar to the surge in exchange whale ratio during the Bitcoin price rise in late 2023 and early 2024," CryptoQuant analyst JA Martoon told BeInCrypto.

The current surge in the 30-day moving average further reinforces that whales are becoming more active in exchange activities.

If history repeats, massive whale selling could trigger a correction or increased volatility.

While Bitcoin price currently maintains strength, these changing dynamics suggest the market may be transitioning from accumulation to distribution, increasing the likelihood of a short-term peak or correction.