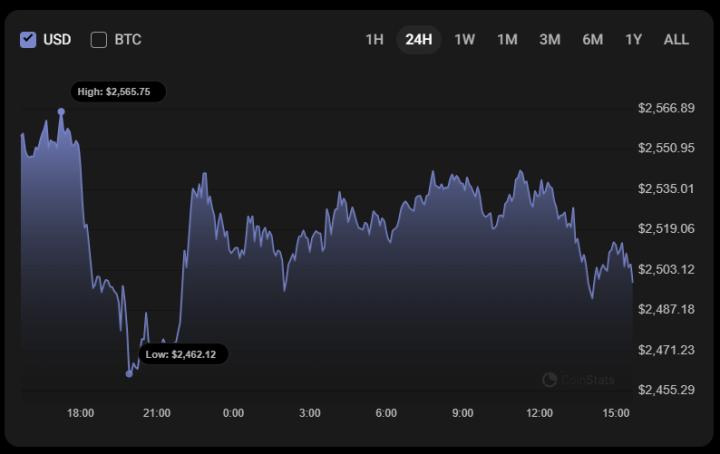

Currently, long liquidity is piling up again around the 102k~103k level, filling up a previous liquidity gap... So, if there’s another long squeeze this week, the price target is most likely around 102k. Meanwhile, we saw a double-bottom retest last night, supported by spot buying, and the price didn’t liquidate the longs as expected—this significantly increases the odds of a direct BTC rebound from here. If price breaks the minor “lower highs” structure, the short-term rebound target is around 107.5k. My current strategy is to wait for a potential long squeeze down to 102k before going long again. If price just pumps from here, I’ll probably stay on the sidelines and take it as a break. If the market gives an opportunity, I’ll take it; if not, I’ll relax and let it go! Staying in cash is also a decision, and sometimes it’s even harder than hitting the buy button. It’s easy to know when to enter, but knowing when NOT to enter is worth thinking about.

This article is machine translated

Show original

Crypto_Painter

@CryptoPainter_X

小级别趋势结构目前依旧处于空头优势中,因此继续期待价格对102k的多头流动性进行清算;

昨晚的下跌没有清算干净下方的多头流动性,因此在价格到达102k以前,我不会考虑做多,非要动手的话,我更倾向于等价格反弹至106k去做空。

总结下来,短期似乎没有什么好的交易机会,继续看戏! x.com/CryptoPainter_…

Sector:

Signal Square

Channel.SubscribedNum 35480

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content