The champagne bubbles almost drowned out all the noise on Wall Street. The S&P 500 index has been hitting new historical highs for days, and financial media headlines use words like "bull market," "prosperity," and "AI revolution" to write an inspiring progression for this party. Every time the index jumps to a new integer level, it seems to confirm one thing: the skeptics are wrong, and this time is truly different.

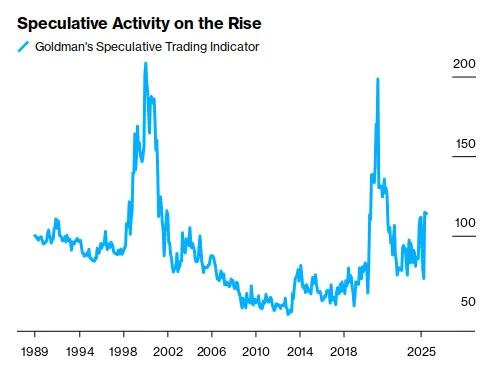

As an investor who has been in the capital markets for over 20 years, I have seen "this time is different" too many times. The frenzy of the 2000 dot-com bubble, the calm before the 2008 financial tsunami - each time, the market's collective narrative was so powerful it was suffocating, until the music suddenly stopped.

Today, I'm not here to throw cold water, nor to predict doomsday. I want to invite you to put down that celebratory champagne and, with me, re-examine the truth of this feast from three dark corners untouched by fireworks.

Because the truth often lies in those unnoticed yet crucial details. Is the foundation of this party as solid as it appears on the surface? Or are we standing on the top of a skyscraper supported by just a few pillars, dancing to the music, completely unaware of the structure's fragility?

[The rest of the translation follows the same approach, maintaining the original structure and translating all text while preserving HTML tags]When everyone has boarded this self-driving train, who will be responsible for hitting the brakes before the cliff?

AI's "Certainty" Dividend is on the Verge of Being Exhausted

Supporting this extremely high valuation is a grand, enticing, and highly certain narrative: AI will bring about the fourth industrial revolution, triggering an unprecedented productivity explosion.

This story is so beautiful that investors are willing to ignore all warning signs. According to historical data, the Shiller Cyclically Adjusted Price-to-Earnings (CAPE) ratio has soared to around 37-39 times, which is not only far higher than the historical average of about 17.6 times but also reaches the third-highest valuation level in history.

The previous two times it reached similar heights were before the Great Depression in 1929 and during the dot-com bubble in 2000. We are paying a price today that cannot be sustained for a dream of "tomorrow".

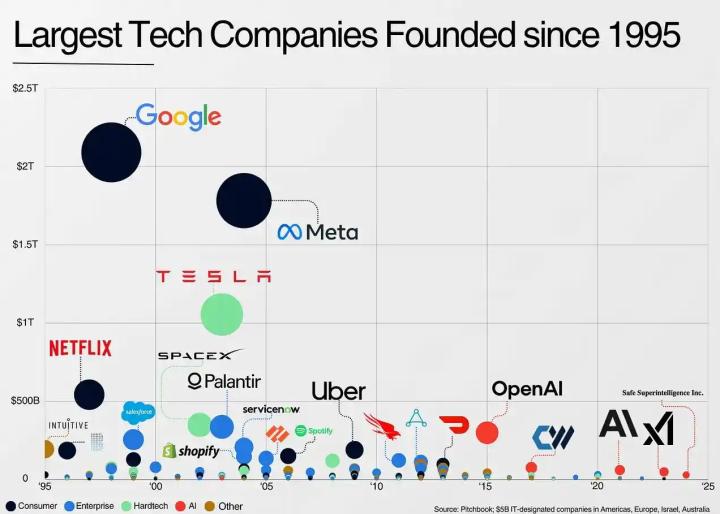

The problem is that this narrative overlooks human impatience and the reality of technology adoption. People always overestimate the short-term impact of new technologies and underestimate their long-term transformation. When investors cannot see explosive profits from AI in the short term (except for a few chip and cloud companies), disappointment will begin to spread.

The current market is essentially discounting the value of all potential AI applications to today. This is not paying for a price-to-earnings ratio, but a "Price-to-Dream Ratio". Apart from Nvidia and a few cloud giants, how many AI application-layer companies have truly achieved significant profit growth? If the answer is rare, it means that the profit distribution along the value chain is extremely unbalanced, and this unbalanced frenzy is the breeding ground for bubbles.

Don't Be Misled by the "Market Breadth Improvement" Argument

At this moment, someone will definitely jump out to refute, bringing out data to tell you: "Don't worry, market breadth is improving". They will say that recently, not only are the tech giants rising, but the S&P 500 equal-weight index is also hitting new highs, proving that the rally is healthy and comprehensive.

This is a typical argument that uses partial facts to obscure the whole truth. Indeed, data shows that the profit growth expectations for the "S&P 493 companies" outside the tech giants have improved, seemingly mitigating the risk of market concentration. But this is like saying that the seven main beams supporting a building have cracks, but we're glad to find that a few decorative columns have become slightly more robust.

The key issue is "weight". Even if the other 493 companies perform well, their combined influence cannot be compared to those seven giants. As long as the leading tech giants sneeze, the entire market will still catch a cold.

The AI narrative and passive investment funds still firmly tie the core market driving forces to those few companies. Therefore, the so-called breadth improvement is more like an appetizer before the main course, which may improve the party atmosphere but cannot change the core risk that the main course might be poisonous.

Amid the Applause, Listen More to the Sound of Cracks

In writing this, my purpose is not to predict when the market will crash. Anyone who tries to precisely predict market turning points is either a fraud or a fool. What I want to convey is a way of thinking: amid the full applause and cheers, we need to listen more to those subtle, discordant crack sounds.

The current S&P 500 new high is built on an extremely concentrated, passively catalyzed, and fragile foundation supported by a grand but not yet fully realized AI narrative. It's like a spectacular fireworks show, dazzling, but we can't just look up; we must also see clearly whether we are standing firmly on solid ground.

Next time, when you see the index hitting a new high, try to ask yourself a few questions: Today, is it the victory of the seven giants or the advance of the 493 troops? What is driving the rise - rational value discovery or passive fund inertia? Have we paid a price for the AI dream that has already exhausted the growth of the next decade?

In the torrent of capital, maintaining a clear and independent thinking is far more important than following the crowd's revelry. Because only then, when the music stops, will you not be the last person to discover that the party is over.