According to Timothy Peterson, who wrote a book on the Bitcoin value model based on Metcalfe's law, the cryptocurrency industry may face another bear market.

This analysis comes as the Federal Reserve (Fed) maintains a cautious stance on interest rates despite economic uncertainty.

Analyst Explains Bear Market Unfolding

In a recent analysis shared on X (SNS), Peterson warned that the market is currently overvalued, making it vulnerable to a decline. While a trigger is needed for such a decline, he suggests that the Fed's decision to hold interest rates could be a sufficient trigger.

"It's time to talk about the next bear market. There's no reason it shouldn't happen now. The valuation justifies it. What's needed is a trigger. I think that trigger could be the Fed's decision not to cut rates at all this year." – Peterson

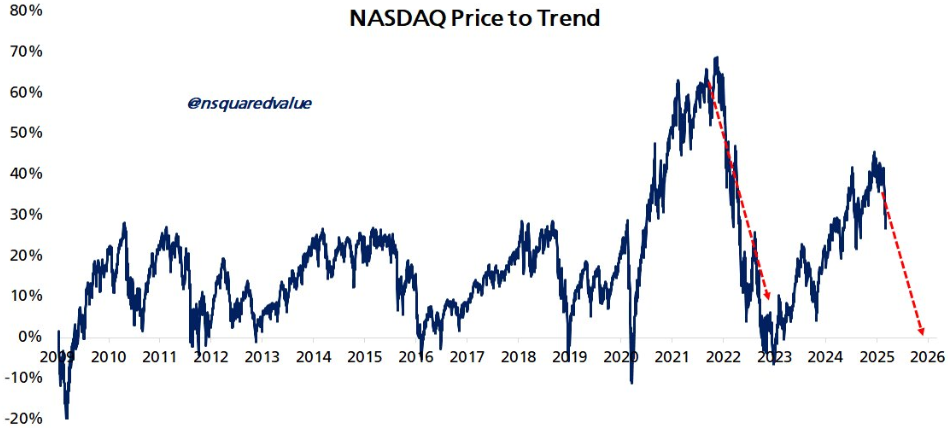

Peterson's analysis compares past market declines with the current situation. Based on the Nasdaq, he estimates that the bear market could last between 7 and 14 months.

With the Nasdaq currently 28% overvalued, he expects it to decline by around 17%, bringing the index down to 15,000.

Applying this prediction to Bit, Peterson expects Bit to decline by around 33%, bringing the Bit price down to around $57,000.

"1.9x. Nasdaq 17% decline = Bit 33% decline -> $57,000," – Peterson

However, he mentions that opportunistic investors could intervene early, preventing Bit from falling that low and finding support around $71,000.

This aligns with a recent analysis by Arthur Hayes. According to BeInCrypto, the Bit founder argued that Bit could drop as low as $70,000.

Analysts have also highlighted the gap below Bit's $93,198 all-time high, noting that there is little significant support until the $70,000 range.

The Fed's Role in Market Decline

About a month ago, Federal Reserve Chair Jerome Powell said the Fed would not rush to cut interest rates. Last week, he emphasized the need for patience in a speech at the New York Policy Forum.

"We don't need to be in a hurry, and we can wait for a clearer picture to emerge," – Powell

Powell's remarks came amid economic uncertainty caused by changes in President Donald Trump's trade policies, immigration, fiscal policy, and regulation. With inflation remaining at 2.5%, the Fed is cautiously navigating these challenges.

Despite market expectations for interest rate cuts this year, Powell made it clear that the Fed will wait before adjusting monetary policy.

Amid growing concerns about an impending Fed-led decline, Bit has recently fallen following the Fed's recession warning. The Fed expects GDP to decline by 2.8% in Q1 2025, raising concerns about economic instability, which has negatively impacted investor sentiment.

Despite these warnings, Peterson is not convinced that a full-blown bear market is imminent. He argues that the current market situation is different from the euphoric conditions of previous bubbles. The analyst also explains that the bearish sentiment among investors may signal a long-term buying opportunity, rather than a sell-off signal.

According to BeInCrypto data, Bit is trading at $86,026 at the time of writing, down 0.1% since the start of the Sunday session.