Welcome to the US Morning Crypto Briefing - We'll inform you about today's key cryptocurrency developments.

Prepare your coffee to check if Bit is maintaining above $79,000 despite stock market decline. The market is preparing for the March NFP report and increasing recession risks. With discussions of Federal Reserve rate cuts and continued strong ETF inflows, we are watching the next moves in macro and cryptocurrency markets.

Bit, a Bear Market?

The highly anticipated March US Non-Farm Payrolls (NFP) report is scheduled to be released late today and is expected to play a crucial role in shaping market sentiment ahead of the weekend.

"Since major macro risk events have now passed, focus shifts to tonight's Non-Farm Payrolls report. Investors are watching for signs of weakness in the US labor market. Weaker-than-expected figures could support additional Federal Reserve rate cuts this year as policymakers attempt to ease a slowing economy. At the time of writing, the market anticipates four rate cuts in 2025—0.25bps each in June, July, September, and December," said QCP Capital analysts.

Traditional markets are increasingly pricing in recession and stocks are sharply retreating—7% decline overall, 5% drop just yesterday. This broad risk-averse environment helps explain the current pause in cryptocurrency inflows.

On the derivatives side, QCP adds: "In terms of options, the desk continues to observe high short-term volatility, with more people purchasing downside protection. This distortion emphasizes the current uncertain and cautious atmosphere." However, they also note that "current positioning is light, and with risk assets largely oversold, the stage may be set for a short-term rebound."

Bit is maintaining above $79,000 despite market volatility, showing strong ETF inflows and signs of separation from stocks and altcoins. According to cryptocurrency analyst and investor Nick Puurin, founder of Coin Bureau: "Bit is not in a bear market at this stage. The future of many altcoins is more questionable."

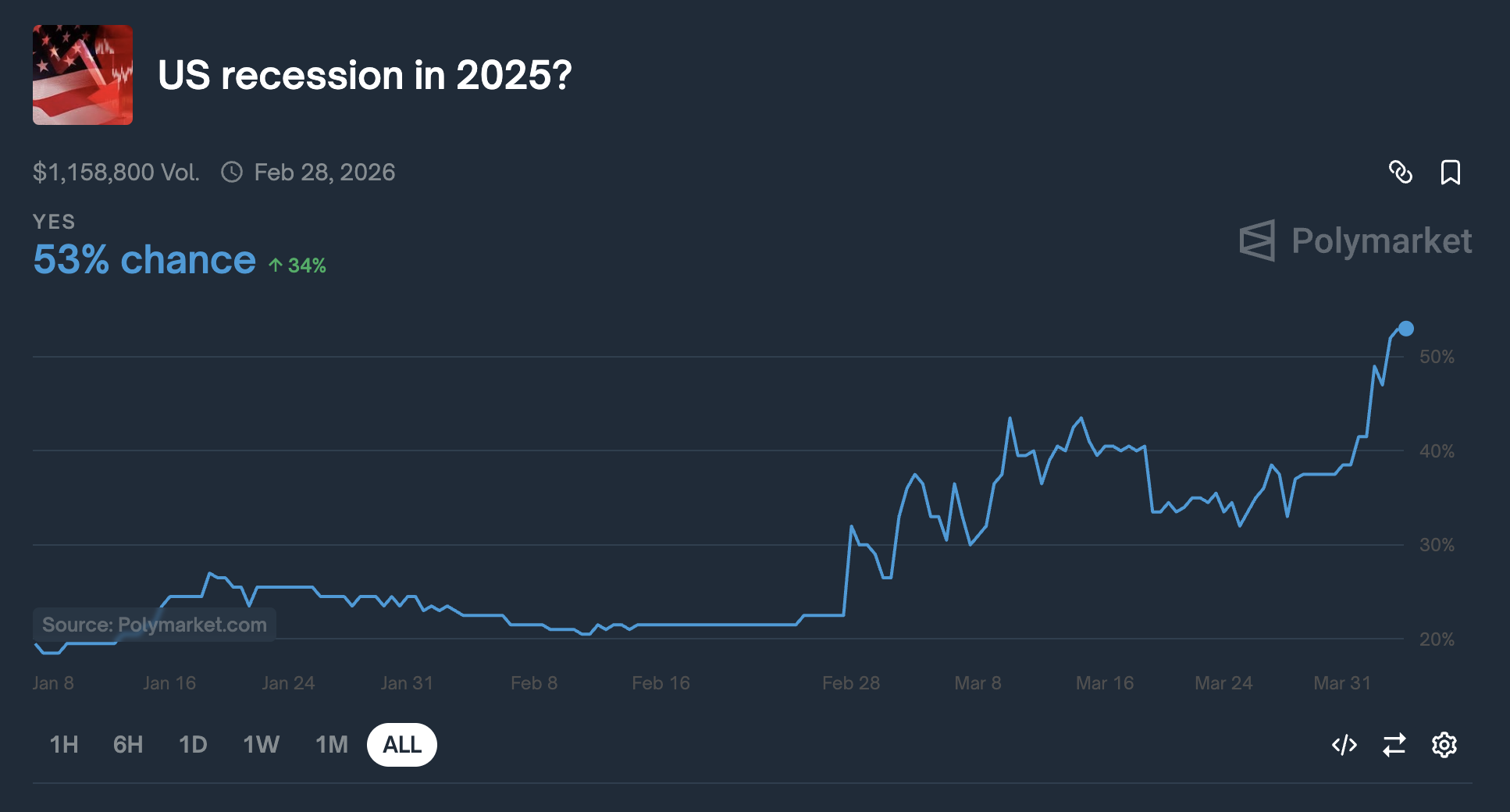

Today's Chart

The probability of a US recession in 2025 has exceeded 50% for the first time, currently at 53%.

Today's Key News

– Major ETF issuers are buying Bit, with $220 million in inflows showing strong confidence despite volatility.

– Futures show bullish sentiment on Bit, but options traders remain cautious, signaling mixed market outlook.

– Coinbase launches XRP futures after Illinois lawsuit relief, indicating increasing regulatory support for cryptocurrency.

– Despite Trump's tariff shock, analysts see potential Bit rebound—though inflation may limit the rise.

– Anti-CBDC bill passes major House vote, aiming to block Federal Reserve-issued digital currency and protect privacy.

– Federal Reserve Chair Jerome Powell is scheduled to give a speech on the US economic outlook at 11:25 AM US time today.